Do I Qualify for the EITC?

You qualify for the EITC if:

you have earned income and adjusted gross income within certain limits; AND

you meet certain basic rules; AND

you either:

have a child that meets all the qualifying child rules for you (or your spouse if filing a joint return).

Use the EITC Assistant to find out your filing status, your child’s status as a qualifying child, your eligibility for the credit, and estimate the amount of the credit you may get.

EITC has special rules that apply for members of the military, members of the clergy, and taxpayers with certain types of disability income or children with disabilities.

Basic Rules

Social Security Number

You, your spouse and any qualifying child you list on your tax return must each have a Social Security number that is valid for employment and that was issued on or before the due date of your return (including extensions).

Filing Status

your return using one of the following filing statuses:

Married filing jointly

Head of household

Qualifying widow or widower

Single

You can't claim the EITC if your filing status is married filing separately.

If you, or your spouse, are a nonresident alien for any part of the year, you can’t claim the EITC unless your filing status is married filing jointly. You may use that filing status only if one spouse is a U.S. citizen or resident alien and you choose to treat the nonresident spouse as a U.S. resident. See Publication 519, U.S. Tax Guide for Aliens (PDF), to find out if you are eligible for the EITC.

Certain Rules for Income Earned During 2019

Your tax year investment income must be $3,600 or less for the year.

Must not file Form 2555, Foreign Earned Income or Form 2555-EZ, Foreign Earned Income Exclusion.

Your total earned income must be at least $1.

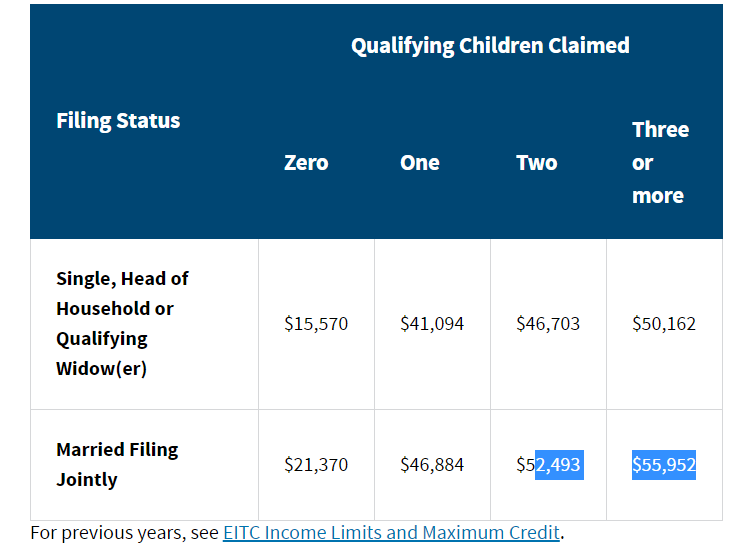

Both your earned income and adjusted gross income (AGI) must be no more than:

Additional Rules

I Have a Qualifying Child

If you (and your spouse if filing a joint return) meet the criteria above and you have a child who lives with you, you may be eligible for the EITC. Each child you claim must pass the relationship, age, residency and joint return tests to be your qualifying child. See the Qualifying Child Rules for guidance.

I Don't Have a Qualifying Child

If you (and your spouse if filing a joint return) meet the basic EITC rules for everyone, you qualify for the EITC:

You (and your spouse if filing a joint return) have your main home in the United States for more than half of the tax year; AND

You (and your spouse if filing a joint return) cannot be claimed as a dependent or qualifying child on anyone else's return; AND

You (or your spouse if filing a joint return) must have been at least 25 but under 65 years old at the end of the tax year.

Exceptions

Special EITC rules apply for members of the military, ministers, members of the clergy, those receiving disability benefits and those impacted by disasters.

Many persons with disabilities or persons having children with disabilities qualify for the EITC.

When Can I Expect My Refund?

If you claim the earned income tax credit (EITC) or the additional child tax credit (ACTC) on your tax return, by law the IRS can't issue your refund before mid-February — even the portion not associated with the EITC or the ACTC. Find out more on when to expect your refund.

After you file your return, the best way to track your refund is Where's My Refund? or the IRS2Go mobile app.